Variety of business decisions

a. Make or buy.b. Drop or retain a business segment.c. Accept or reject a special order.d. Determine the most profitable use of a constrained resources.e. Sell or process furtherWhat is mean of relevant cost (it is not sunk cost / opportunities cost)

Relevant Cost Analysis: A Two-Step Process

Step 1: Eliminate costs and benefits that do not differ between alternatives.

Step 2 : Use the remaining costs and benefits that differ between alternatives in making the decision. The costs that remain are the differential, or avoidable, costs.

Nhìn chung dạng này liệt kê các thành phần của income statement ra và xác định sales, variable cost, lợi nhuân biên CM , fixed cost và income.

Sales

Less Variable cost:

VC 1

VC 2

VC 3

CM

Less Fixed cost

FC 1

FC 2

FC 3

Income

VD 1:

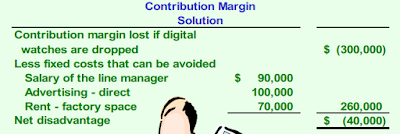

Adding/Dropping Segments :

Như vậy cần phải dừng sản xuất

VD2:

The Make or Buy Decision

to buy externally from a supplier is called a “make or buy” decision

► Essex Company manufactures part 4A that is used in one of its products. The unit product cost of this part is:

Direct materials $ 9

Direct labor 5

Variable overhead 1

Depreciation of special equipment 3

Supervisor's salary 2

General factory overhead 10

Direct labor 5

Variable overhead 1

Depreciation of special equipment 3

Supervisor's salary 2

General factory overhead 10

-------

Unit product cost $ 30

Unit product cost $ 30

►The special

equipment used to manufacture part 4A has no resale value.

►The total

amount of general factory overhead, which is allocated on the basis of direct

labor hours, would be unaffected

by this decision.

►The $30 unit product cost is based on 20,000 parts produced each year.

►An outside supplier has offered to provide the 20,000 parts at a cost of $25 per part.

Should we accept the supplier’s offer?

►The $30 unit product cost is based on 20,000 parts produced each year.

►An outside supplier has offered to provide the 20,000 parts at a cost of $25 per part.

Should we accept the supplier’s offer?

Do vậy , cần sản xuất

VD 3

Special Orders

Ø Jet

Corporation. makes a single product whose normal selling price is $20 per unit.

Ø A foreign distributor offers to purchase 3,000 units for $10 per unit.

Ø This is a one-time order that would not affect the company’s regular business.

Ø Annual capacity is 10,000 units, but Jet Corporation is currently producing and selling only 5,000 units.

Should Jet accept the offer?

Ø A foreign distributor offers to purchase 3,000 units for $10 per unit.

Ø This is a one-time order that would not affect the company’s regular business.

Ø Annual capacity is 10,000 units, but Jet Corporation is currently producing and selling only 5,000 units.

Should Jet accept the offer?

Increase in revenue (3,000 × $10) $30,000Increase in costs (3,000 × $8 variable cost) 24,000

-------------Increase in net income $ 6,000

Note: This answer assumes that

the fixed costs are unavoidable

and that variable marketing costs must be incurred on the special order.

VD 5 - sử dụng tài nguyên hạn chế Utilization of a Constrained Resource

- When a limited resource of some type restricts the company’s ability to satisfy demand, the company is said to have a constraint.

- The machine or process that is limiting overall output is called the bottleneck – it is the constraint.

►Fixed costs are usually unaffected in these situations, so the

product mix that maximizes the company’s total contribution

margin should ordinarily be selected.

►A company should not necessarily promote those products that have the highest unit contribution margins.

►Rather, total contribution margin will be maximized by promoting those products or accepting those orders that provide the highest contribution margin in relation to the constraining resource.

►A company should not necessarily promote those products that have the highest unit contribution margins.

►Rather, total contribution margin will be maximized by promoting those products or accepting those orders that provide the highest contribution margin in relation to the constraining resource.

Ensign Company produces two products and selected data are shown below:

►Machine A1 is the constrained resource and is being used at

100% of its capacity.

►There is excess capacity on all other machines.

►There is excess capacity on all other machines.

►Machine A1 has a capacity of 2,400 minutes per week.

Should Ensign focus its efforts on Product 1 or Product 2?

Should Ensign focus its efforts on Product 1 or Product 2?

The key is the contribution margin per unit of the constrained resource.

Ensign should emphasize Product 2 because it generates a contribution margin of $30 per minute of the constrained resource relative to $24 per minute for Product 1.

The key is the contribution margin per unit of the constrained resource.

Ensign can maximize its contribution margin by first producing Product 2 to meet customer demand

and then using any remaining capacity to produce Product 1. The calculations would be performed as

follows.

and then using any remaining capacity to produce Product 1. The calculations would be performed as

follows.

According to the plan, we will produce 2,200 units of Product 2 and 1,300 of Product 1. The contribution margin looks like this

Nice one. MBA notes on management

Trả lờiXóa